Q3 2025 Market Commentary

- Aug 21, 2025

- 7 min read

The financial markets ended the first quarter with a sharp sell-off centered around high valuations and tariffs. In our opinion, the threat of tariffs forced investors to focus on valuations, which are high by all historical measures. Financial markets hate uncertainty, and tariffs create uncertainty, and they reduce corporate profit margins as companies are forced to relocate factories from cheap areas to more expensive areas. Long term tariffs have the potential to bring back industry and jobs to America, but in the short term they will hurt corporate profits, and possibly increase inflation through higher imported prices. Thus, the market sold off earlier in the year. While still on going, investors seem to now feel that the worst-case scenario of embargo like tariffs on China seem unlikely to materialize. Moreover, the initial fear of inflation has not materialized as the inflation rate has actually gone down over the last two months, and the fear of recession has also diminished as the Atlanta Federal Reserve Bank GDPNow (Gross Domestic Product Nowcasting) model is estimating Q2 Gross Domestic Product growth at +3.8% as of June. This in conjunction with continuing rapid advances in AI (Artificial Intelligence) caused the market to rebound in the second quarter. However, the economy was not in massive trouble in Q1, and it is not booming in Q2. In this commentary, we will discuss these AI developments, as well as ongoing trade talks, as well as why we believe the financial market may be once again getting overly bullish today.

The market is now pricing in that the trade wars are over, as the market has recovered all of its trade induced losses. However, the reality is trade negotiations usually take a long time to negotiate.

Morgan Stanley pointed out in the end of June that the free trade arrangements the U.S. has negotiated in the past took an average of three years to work out. Thus, speculating that tariffs are finalized seems premature at this point. We would expect to see some more market volatility in the future around trade. That being said, the USA is running such a massive trade deficit with the rest of the world that any improvement in the deficit, increased exports or reduced imports could be considered a victory and cause the equity markets to move higher. What we believe that is having a major impact on financial markets today is Artificial Intelligence (AI). AI continues to improve rapidly and is already allowing leading companies to do more with less, potentially leading to higher profit margins and earnings.

Companies have always employed technology to increase their profit margins and profits. Currently, Wall Street is excited about Artificial intelligence (AI) because AI is speeding up this process. In 2025, UBS expects global AI spending to rise by 60% year over year to $360 billion. Another forecast from Gartner predicts worldwide generative AI spending to $644 billion in 2025, an over 76% increase from 2024. Artificial Intelligence learns by processing vast amounts of data and identifying patterns, much like humans learn from experience. This learning process is typically facilitated by algorithms, which are sets of rules or instructions that guide the AI's analysis and decision-making. AI systems improve their performance over time by analyzing data and adjusting their internal models. The more AI learns, the more tasks within a company it can handle. Today, AI agents, a type of artificial intelligence can already understand and respond to customer inquiries without human intervention and are not only being infused into software but also into robotics.

For example, Amazon is one of the companies leading the charge, they just hit a milestone of adding their one millionth robot, Amazon will soon have as many robots as humans. In fact, last month, Amazon CEO Andy Jassy stated that Al won’t just effect change at Amazon but rather “AI will change how we all work and live,” including “billions” of AI agents “across every company and in every imaginable field.” “Many of these agents have yet to be built, but make no mistake, they’re coming, and coming fast,” Jassy said.

This story is happening among many companies across the country. Moreover, executives are increasingly no longer hiding that advances in AI will cut jobs. Ford Motor Chief Executive Jim Farley said in an interview that “Artificial Intelligence is going to replace literally half of all white-collar workers in the U.S.,” and that “AI will leave a lot of white-collar people behind.” In May, the Wall Street Journal reported that the CEO of JP Morgan’s Consumer and Community Banking told investors that “she could see its operations head count fall by 10%” even as the top line revenue continues to expand. CEO Dario Amodei of Anthropic (an advanced AI products company focused on large language models under the “Claude” brand) went further. He stated in May during an interview with Axios, that “half of all entry-level jobs could disappear in one to five years, resulting in U.S. unemployment of 10% to 20%.” At Shopify Chief Executive Tobi Lutke recently told workers that the company wouldn’t make any new hires unless managers could prove Artificial Intelligence is not capable of doing the job. Covid vaccine maker Moderna has asked staffers to launch new products and projects without adding head count. Already we are seeing companies cut back on labor even as their sales increase.

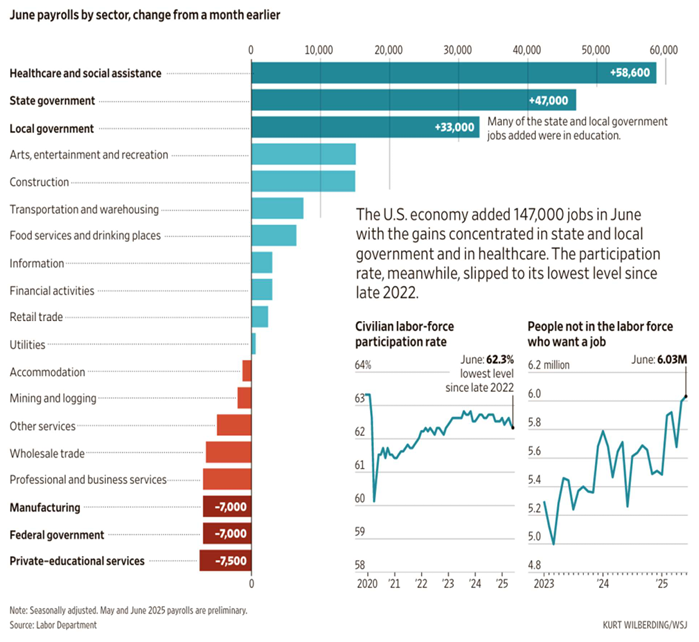

Reducing labor forces will be good for both corporate profits and the economy as long as displaced workers can find new jobs with similar benefits. So far this appears to be the case, which is one of the leading reasons we believe the market has been going higher. However, this is where we feel investors may be beginning to get overly optimistic. The latest job survey reports 147,000 new jobs were created, meaning that companies are getting more efficient (higher profits) while at the same time the unemployment rate remains very low, signaling that plenty of jobs are still available. This is a goldilocks scenario for both the economy and financial markets. However, another source of payroll data is the ADP National Employment report which focuses primarily on the private sector. ADP payroll databases are continuously updated using aggregated payroll data of more than 25 million U.S. employees to provide a near real time picture of the private sector labor market. The ADP data shows the employment increased by only 37,000 jobs in May. This is a big difference. Meanwhile, the continuing unemployment claims number has just hit a four year high, signaling that the labor market may not be as robust as the survey data suggest.

Moreover, the survey data, when broken down (chart below) shows most of the employment gains were from state and local governments (an unsustainable trend in an era of tighter budgets). In addition, the civilian labor force participation rate remains below pre-covid levels.

By having a lower labor participation rate, the unemployment rate looks lower as well.

In addition, we continue to be concerned about financial markets elevated valuation levels. The price/earnings (P/E) ratio is the most widely followed measure of stock valuation. Currently the P/E ratio of the S&P 500 index stands at 22 at the end of the quarter, this is 500 basis points (a basis point is one hundredth of a percent) above the 30-year average. The Shiller (P/E) ratio called CAPE (cyclically adjusted price earnings) ratio is 930 basis points above average. Likewise, the current dividend yield on the index is also below the long-term average while the “EY spread” is currently negative. The EY spread refers to earnings yield spread, and is the difference between a company’s earnings yield and yield of a government bond, usually a 10year Treasury bond.

The chart from JP Morgan above is also concerning as it highlights in green the trading distributions of two standard deviations of price/earnings valuations over time. These distributions account for 68% of all transactions and show a high end of the range at 20.2 times earnings and a low end of the range at 13.7 times earnings. Earnings above the high end of the range only occur 16% of the time, and the current valuation level is 10% above the high end of the range. So, if earnings estimates get revised down, unemployment worsens, or unexpected shocks hit the financial markets we could see reversion to the mean, and have valuations fall back to within historical levels like we saw earlier in the year.

In conclusion, the financial markets have had an impressive comeback rally since the beginning of the quarter. We believe this rally has been driven by advances in AI technology which companies are already using to reduce cost and increase their profit margins. Moreover, we believe the improvements in AI are accelerating which should bode well for corporate earnings, but could have negative impacts in the future for the labor market. In the meantime, valuations in the equity markets have once again become elevated relative to historical averages. As a result, we continue to like large capitalization companies who are providing goods and services which businesses and consumers need to use on a daily basis and who are returning cash back to investors in the form of dividends or share buybacks as the best risk adjusted returns in an increasingly volatile environment. We hope you all have a great summer.

Thank you for your continued support.

Sincerely,

This newsletter is distributed for general informational purposes and does not constitute investment advice nor is it intended to constitute legal, tax, or accounting advice. No part of this newsletter nor any links contained therein is a solicitation or offer to sell investment advisory services except where applicable in states where we are registered, or where an exemption or exclusion from such registration exists. Information throughout this newsletter is obtained from sources which we believe reliable, but we do not warrant or guarantee the timeliness, accuracy or completeness of this information and the information presented should not be relied upon as such. All investments involve risk of loss, including the possible loss of all amounts invested, and nothing within this newsletter should be construed as a guarantee of any specific outcome or profit. This newsletter is confidential and is intended solely for the information of the person to whom it was delivered and may not be reproduced or redistributed in whole or in part nor may its contents be disclosed to any other person under any circumstances. The information contained in this document is believed to be accurate as of the date hereof and is subject to change without notice. Schnieders Capital Management is not affiliated with any of the companies or indexes mentioned in this newsletter.

Comments